AMFI Registered Mutual Fund Distributor

Our Services

CEBR Financial Services Pvt. Ltd. provides its clients complete service from beginning to the end. Our services are designed keeping in mind our Customised Service concept. Our service is a combination of Planning, Implementation and Review. As our experience, few clients wants to join us in mid and want to continue with us for full service so we have provided three services as a combination as well as three separate facility.

Our organisation provides these services:

Planning

Planning is a first step which includes deciding in advance what is to be done, when where, how and by whom it is to be done. Planning bridges the gap from where we are to where we want to go. It includes the selection of objectives, policies, procedures and programmes from among alternatives. A plan is a predetermined course of action to achieve a specified goal. It is an intellectual process characterized by thinking before doing. We provide a comprehensive financial services on a customised basis. If anyone wants to avail only this opportunity, we can do that. We at CEBR provides services of Investments in various aspects:

Risk Management

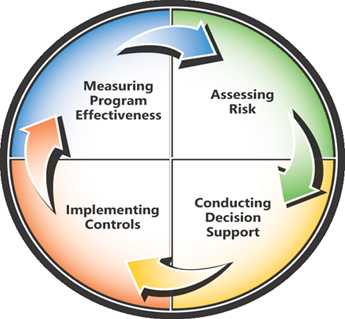

Risk Management is a process of identification and assessment of risk followed by proper application to minimize risk and maximise the opportunities. Risk management is done in two parts:

- Determine what risks exist in an investment.

- Handling of those risks in a best way as per the client’s investment.

In everyone’s life, there are lots of uncertainties and the same directly refers to risk associated with it. We provide solution for it by including it in the part of financial planning. We cover both type of risk through the two financial instruments:

- Life Insurance: - It covers risks associated with the life of an Individual. We advice Term Insurance and others as per the client’s financial needs.

- General Insurance: - It covers risks associated other than the life. In this, risk associated with the home, Automobile and other non-living things are covered.

Asset Allocation

Asset allocation is a way of diversifying investment that attempts to balance risk and return by adjusting the percentage of each asset in an investment portfolio according to the investors risk tolerance, goals and investment time horizon.

Asset allocation is based on various factors i.e. Income, Age, Goals, Risk and return. Having the expertise, financial planners are able to decide asset allocation that can fulfil the requirement of an individual.

Investment Servies

Success as an investor depends upon his investment in right instrument in right time and for the right period. This, in turn, depends on the requirements, needs and goals. For most investors, however, the three prime criteria of evaluating any investment option are liquidity, safety and level of return.

Investment means putting the hard earned money to work to earn more money. Done wisely, it can help you meet financial goals. We help the clients to make right investment for the fulfilment of their goals.

Our financial planners provide customised services by suggesting investment instrument as per the risk appetite ,expected return of a client and other factors that may include Mutual Funds(Equity, Debt, FMP), Commodity, Real Estate, PMS, Private Equity, Customised Fixed Yield Funds, Bank/ Corporate Deposits and PPF etc.

Retirement Planning

Retirement planning is done for the purpose of living of life after which paid work ends. This includes both the aspects- Financial and Non- financial. In the financial aspect, requirement related to expenses and small savings are counted while in the non-financial aspect, lifestyle choices are taken care of, as how to spend time in retirement, where to live, when to completely quit working, etc.

Nowadays the non-financial aspect of retirement planning is getting higher weight than the financial one. The reason is that people now wants to maintain the same standard of living after retirement as well.

Our experts provide a holistic solution for retirement planning including both aspects-non- financial and financial. We help clients to live tension free by managing their money in such a way that they can enjoy their old age days as golden days.

Tax Planning

Tax planning encompasses many different aspects, including the timing of both income and purchases and other expenditures, selection of investments and types of retirement plans, as well as filing status and common deductions.

The purpose of tax planning is to discover how to accomplish all of the other elements of a financial plan in the most tax-efficient manner possible. It simply includes reduction of tax liabilities and the freeing-up of cash flows for other purposes.

Many times good investment return turns into normal ones after paying tax. We as a financial planners keep tax planning in mind in suggesting investment avenues to generate better returns post tax for the fulfilment of life goals on time.

Tax planning being a very important factor, we have a separate expert panel of Chartered Accountants who exclusively take care of taxation needs of our esteemed clients. They especially focus on efficient tax planning keeping in mind the life goals of an individual.

Estate Planning

Planning is a first step which includes deciding in advance what is to be done, when where, how and by whom it is to be done. Planning bridges the gap from where we are to where we want to go. It includes the selection of objectives, policies, procedures and programmes from among alternatives. A plan is a predetermined course of action to achieve a specified goal. It is an intellectual process characterized by thinking before doing. We provide a comprehensive financial services on a customised basis. If anyone wants to avail only this opportunity, we charge separately for that. We at CEBR provides services of Investment in various aspects:

Implementation

As a part of financial services, there are a lot of investment products in which you need to invest. Client’s service being the first priority, we help in implementation of the plan. We provide this facility to those clients whose financial services is done by our team. If any other person wants to avail this service, they will be charged separately for that.

We provide following products:

Review

Review is an evaluation of the plan. Review should look at the effectiveness of action plan whether the activities and projects were successful or not. As we know that the changes in economy and behaviour of people are permanent, performance of investment also changes. Review helps to make plans better next time if any correction is required. We provide review of plans yearly, half-yearly or quarterly depending upon client’s need and market scenario. It is generally included in our combination of services but for those who needs only this service, we can help them.